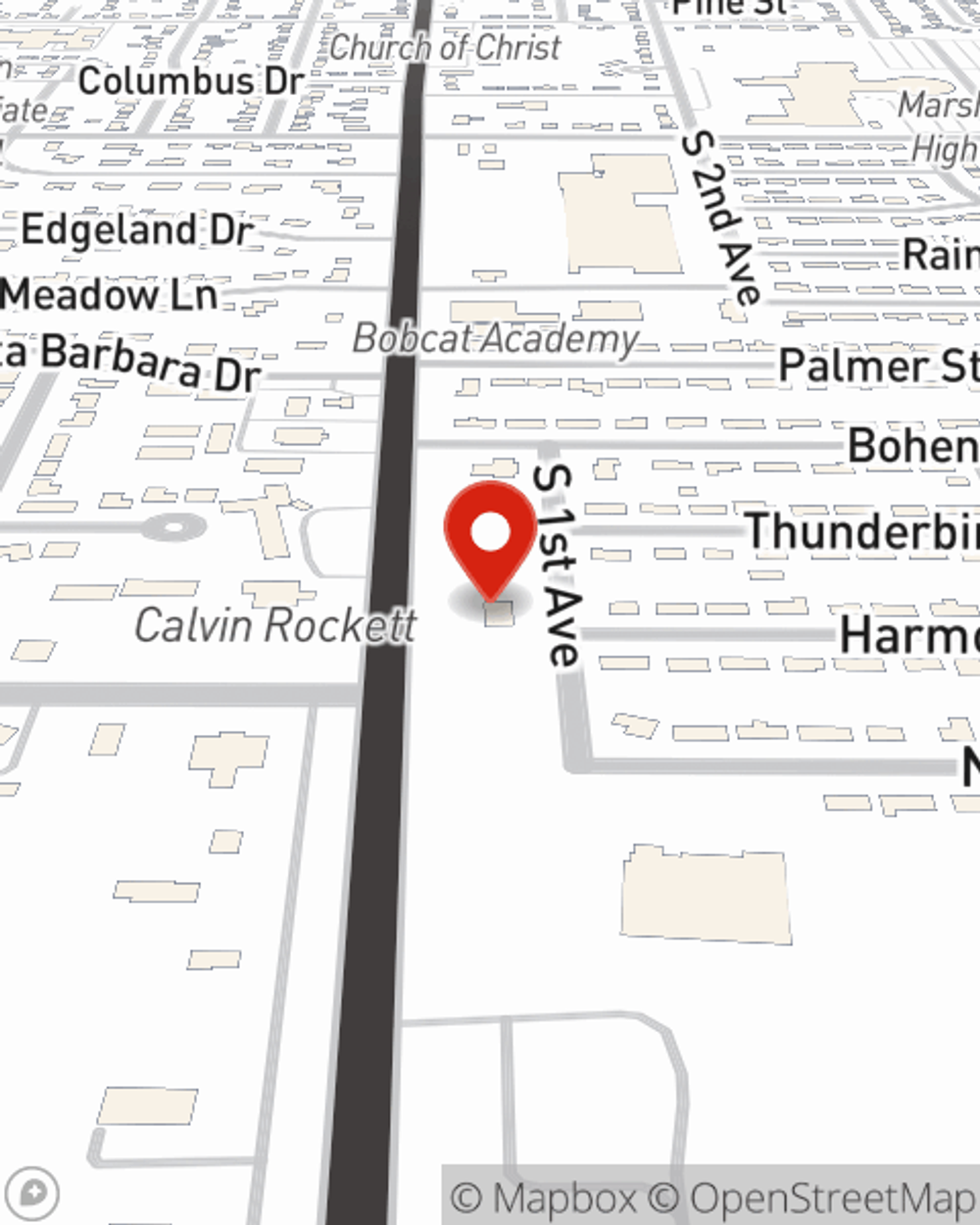

Renters Insurance in and around Marshalltown

Your renters insurance search is over, Marshalltown

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Marshalltown

- State Center

- Melbourne

- LeGrand

- Tama

- Toledo

- Albion

- Marshall

- Grundy

Protecting What You Own In Your Rental Home

Your rented condo is home. Since that is where you rest and spend time with your loved ones, it can be a wise idea to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your hiking shoes, children's toys, video games, etc., choosing the right coverage can help protect you from the unexpected.

Your renters insurance search is over, Marshalltown

Renting a home? Insure what you own.

Why Renters In Marshalltown Choose State Farm

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented space include a wide variety of things like your TV, desk, stereo, and more. That's why renters insurance can be such a good decision. But don't worry, State Farm agent Tyler Peschong has the experience and dedication needed to help you evaluate your risks and help you keep your belongings protected.

A good next step when renting a home in Marshalltown, IA is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and find out how State Farm agent Tyler Peschong can help you.

Have More Questions About Renters Insurance?

Call Tyler at (641) 752-1002 or visit our FAQ page.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Tyler Peschong

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.